Rearming and Innovating

Russia’s Defense Industry and China’s Technological Advancements

Welcome back, security scholars.

I return this week with two compelling reports to share with you all. Their topics include:

Over two years into the war, how is Russia’s military-industrial base faring in the face of Western sanctions?

What is a framework to measure the defense-related science and technology (S&T) innovation of potential adversaries?

Quick Tanks is a weekly collection and summary of the latest long-form analytic content on the topics of US defense, force structure, innovation, and policy considerations. We strive to aggregate all of the key sources of analysis and present brief, neutral summaries to help keep you informed. Should you feel inclined to learn more about any study, please reference the full report via the links provided.

The sponsor of the newsletter is the Hudson Institute’s Center for Defense Concepts + Technology.

Tank you for sharing and subscribing, and happy reading.

Back in Stock?

The State of Russia’s Defense Industry after Two Years of the War

By Maria Snegovaya, Max Bergmann, Tina Dolbaia, Nick Fenton, and Samuel Bendett

Center for Strategic and International Studies

Link to PDF; Link to Report Page

Focus: The report analyzes the current state of Russia's defense industry in the context of its ongoing war with Ukraine. It assesses Russia's evolving weapons production, import diversification efforts, and military-industrial vulnerabilities.Analysis: The report leverages global supply chain data, import-export records, and satellite imagery. Additionally, the report employs expert interviews, on-the-ground observations, and open-source intelligence to provide a comprehensive assessment of Russia's defense capabilities and limitations.Argument: Despite significant challenges posed by Western sanctions and the ongoing war, Russia has managed to adapt and sustain its defense industry. Through import diversification, leveraging pre-existing stockpiles, and ramping up domestic production, Russia has mitigated some of the impacts of sanctions. However, it remains heavily reliant on foreign components and faces several unresolved issues that could impact its long-term military effectiveness. Insights:

- Russia has shifted to lower-cost, lower-quality weapons effective for a war of attrition.

- Russia has diversified its import sources, including increased reliance on countries like China, Iran, and North Korea for critical military components.

- Corruption and labor shortages have been particularly straining on Russia's military-industrial complex.Recommendations: See below for the full list of recommendations.The State of Russian Weapons Systems in 2023

In 2023, Russia has notably shifted from high-end, costly weapon systems to more economical, mass-producible alternatives.

“This high-intensity war of attrition has prioritized certain lower-cost and lower-quality weapons like less advanced tanks, armored vehicles, artillery, small drones, and kamikaze UAVs that Russia continues to field in large numbers and that are proving effective. By contrast, more high-tech Russian weapons, such as advanced aircraft and helicopters, have proved vulnerable to Ukrainian countermeasures, leading the Russian military to withhold deploying these systems on the battlefield. Similarly, advanced Russian missiles have fallen prey to Ukrainian interceptors and are in short supply due to a high rate of usage.”

And despite the crushing weight of Western sanctions, Russia has demonstrated remarkable resilience, ramping up domestic arms production to unprecedented levels. Rostec, a state-owned defense conglomerate, stated it increased overall production of tanks by a staggering 700%, light armored vehicles by 450%, and artillery and multiple launch rocket systems by 250% in 2023.

Tanks: Throughout 2023, the Russian military received over 1,500 tanks, experiencing losses between 600-874. Remarkably, approximately 86% of these tanks were refurbished older models such as T-62 and T-55, some equipped with modern upgrades like new radios and reactive armor, indicating a reliance on older stockpiles.

“As the overall quantity of old Soviet tanks in Russian storage likely remains in the several thousands, the Russian MOD can field such vehicles over the course of many months in 2024, assuming they can be refurbished and are not awaiting dismantlement. Public analysis of the Ukrainian battlefield shows that some of these Russian tanks received upgrades such as new radios, modern optics, and additional layers of reactive armor, with the most common upgrade to both newer and older Russian tanks being the anti-drone metal cages and slat armor, often referred to as ‘cope cages.’ According to CSIS’s Mick Ryan, ‘These cages have helped either crush the fuses of Ukrainian antitank weapons before they hit a vehicle’s main armor or forced antitank weapons to detonate before they can penetrate the vehicle.’ The cages have provided an additional layer of physical protection to Russian tanks, thus giving the Russian soldiers more confidence to operate in places with a high risk of Ukrainian drone attacks.”

Artillery: Russian artillery production was robust, with the manufacture of 152-mm rounds quadrupling to one million rounds in 2023. The Russian military fields an estimated 4,700 barrel artillery systems and 1,100 multiple-launch rocket systems. The new Koalitsiya-SV self-propelled artillery system is currently under testing and production, promising enhanced artillery capabilities.

Drones: In a remarkable display of adaptability, Russia has rapidly scaled up its loitering munitions kill chain, deploying a diverse array of short-range tactical FPV drones, mid-range Lancet and Kub drones, and long-range Geran-2 drones. The Russian MOD proudly claimed to have sent an astounding 22,000 drones to the battlefield in 2023 alone.

Missiles: By the end of 2023, Russia had launched approximately 7,400 missiles into Ukraine. And over the past year, domestic missile production surged, with companies doubling or even quintupling their output. Moreover, Russian stockpiles include around 200 Iskander missiles and other variants.

Electronic Warfare (EW) Systems: Russia has deployed numerous EW systems across the front lines, ranging from large stationary complexes to highly mobile, portable systems. In a strategic shift, Russia has prioritized smaller, more easily deployable EW assets to counter the ever-evolving threats posed by Ukrainian forces.

Russia’s Evolving Import Diversification Efforts

In response to sanctions, Russia has increasingly relied on dual-use and civilian technology. Moreover, by continuously modifying its purchasing patterns, Russia has successfully bypassed sanctions and secured crucial support from a diverse array of partners. Notably, electric machinery and microelectronics comprise a third of Russia’s military imports, highlighting the role of electronics in Russia’s warfare strategy.

China: China has become Russia's most significant trade partner, replacing Western imports. Chinese exports to Russia have surged, particularly in semiconductors, machine tool parts, and ball bearings. The total trade between the two nations reached a record $240 billion in 2023, underscoring China's pivotal role in sustaining Russia's defense industry.

Turkey: Turkey, while diplomatically supporting Ukraine, has not joined the Western sanctions regime. Instead, it has become a key supplier of dual-use goods to Russia. Despite recent US sanctions impacting this trade, Turkey exported $158 million in high-priority items to Russia and neighboring countries in the first nine months of 2023.

North Korea: North Korea has significantly bolstered Russia's military supplies, providing over 1,000 containers of defense equipment and munitions, including artillery shells and short-range ballistic missiles. In exchange, Russia is likely to share advanced space technologies with North Korea.

Iran: Iran has supplied Russia with at least 3,700 Shahed drones, crucial for targeting Ukrainian infrastructure. Plans to co-produce these drones in Russia are underway, with a goal of manufacturing up to 10,000 drones by 2025. Additionally, Iran has delivered at least 400 Fateh-110 ballistic missiles to Russia since January 2024.

UAE and India: The UAE has become a hub for dual-use goods entering Russia, although it recently agreed to restrict re-exports. India's exports of engineering items to Russia increased by 130% between 2022 and 2023, despite potential risks of secondary sanctions.

Existing Russian Military Industrial Drawbacks

Despite its adaptations, Russia's military-industrial base faces several significant challenges exacerbated by the prolonged war and sanctions:

Reconstitution Rate: Russia is rapidly depleting its reserve stockpiles, particularly its tank force, relying on older, partially modernized models, posing a significant challenge to its long-term military capabilities.

Ammunition Shortages: While production has increased, maintaining sufficient ammunition supplies remains a challenge, especially for high-intensity conflicts.

Labor Shortages: War-induced migration and attrition have led to critical labor shortages within the defense industry.

Inflationary Pressures: Sanctions and economic instability have driven inflation, impacting the cost and availability of essential materials.

Stretched Arms Exports: Russia's ability to meet arms export commitments is compromised by the need to prioritize its domestic military needs.

Failing Import Substitution: Efforts to replace imported components with domestic alternatives have largely failed, hampering production.

Overreliance on China: Increasing dependence on Chinese imports makes Russia vulnerable to shifts in Chinese policy or international pressure.

Corruption: Pervasive corruption within the defense sector undermines efficient production and procurement processes.

Recommendations

Despite Russia's adaptations, the authors argue the West must continue to apply pressure throughout 2024. The report offers the following recommendations:

Sustain and enhance the supply of higher-end military equipment to Ukraine, outpacing Russia's production rate and prioritizing weapon systems that offer Kyiv a decisive strategic advantage.

Target Russia's oil revenues, which serve as the primary source of income for the government's budget. Proactive measures to suppress the price of Russian oil and the completion of the EU embargo on Russian hydrocarbons are essential steps in undermining Russia's financial capacity to wage war.

Close sanctions loopholes and strengthen the enforcement of existing export controls. This can be achieved through the introduction of more severe penalties for sanctions violations, targeting third-country intermediaries, publicly exposing sanctions violators, and enhancing corporate responsibility for supply chain control.

Engage in collaborative efforts with countries of the Global South that have adopted neutral stances on Russia's invasion of Ukraine.

Commence planning for a strengthened and empowered European defense industry, potentially in partnership with Ukraine.

To more fully engage with the report and the analysis therein, I highly recommend reading the full report.

Measuring China's Science and Technology Progress

A Framework for Assessing Advances Affecting Military Capability

By David A. Shlapak, Chad J. R. Ohlandt, and Jon Schmid

RAND Corporation

Link to PDF; Link to Report Page

As the United States faces increasing strategic competition from China, this report introduces the Military Advances in Science & Technology (MAST) framework, designed to provide early warning of China's critical S&T programs and aid DoD decision-making. The main findings highlight the framework’s ability to identify strategic goals, screen relevant S&T activities, baseline progress, and support informed decision-making.

Why a framework is important?

“The basic research and applied research and development (R&D) phases—and, to some extent, the prototyping phase—represent periods in capability development in which measurable indicators of a competitor’s S&T interests might be relatively weak with a poor signal-to-noise ratio. What’s more, advanced countries, such as China and the United States, might have so many R&D activities underway that it might be difficult to find the needle in the R&D haystack. The United States might get very little early warning of the specific S&T programs that China intends to use to create important new military capabilities—capabilities that U.S. soldiers, sailors, marines, airmen, and guardians might confront in the future. For this reason, a tool that could identify China’s R&D that is fundamental to the PLA, fielding some of these capabilities early in the pipeline, is of immense interest to the military and intelligence communities.”

Put simply, China's increasingly sophisticated S&T base is directly competing with the DoD in advanced technology areas such as artificial intelligence, biotechnology, and quantum sciences, and thus requires close monitoring of China's progress in these fields. In this way, the framework can help:

Focus US R&D objectives and shape modernization priorities by identifying areas where China is making significant progress.

Point the intelligence community toward investigating important new areas of China's S&T activity and assist in allocating intelligence assets and resources effectively based on the framework's findings.

Help combatant commands and Pentagon planners look ahead to assess the potential results of China's S&T undertakings and prepare for future capabilities.

Help DoD inform its whole-of-government and academic and industrial partners, such as the Committee on Foreign Investment in the United States (CFIUS), about S&T areas in which caution should be exercised both in permitting Chinese investment in US firms and in collaborating with Chinese researchers.

The MAST Framework and How It Works

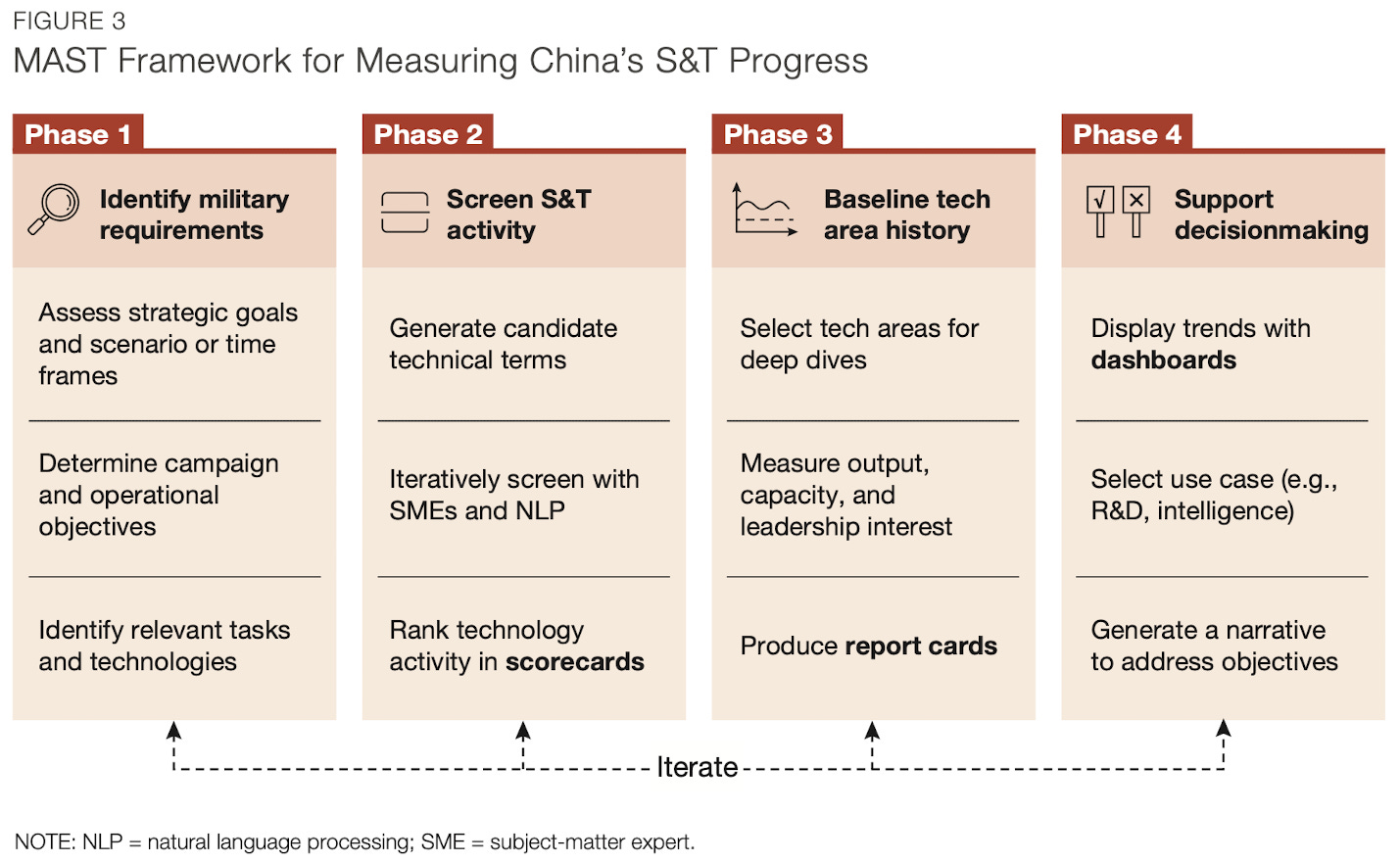

The MAST framework consists of four essential phases:

Identify military requirements: This phase assesses China's future strategic goals and derives critical future PLA capabilities from those goals, identifying new or improved capabilities necessary to execute future missions.

Screen S&T activity: This phase involves iterative, automated scans of patent and publication databases using technical search terms to identify indications of China's outsized interest in technologies related to relevant S&T activity.

Baseline technology area history: This phase assesses the output, capacity, and leadership interest in the technical areas specified by the screening phase, using several metrics across these three categories to create a report card for each S&T area.

Support decision-making: The final phase refines the results from the previous phases into a digestible form for DoD leaders, using dashboards to condense the information and capture the metrics and their trends over a defined period.

Test Cases

The authors applied the MAST framework to two historical test cases: hypersonics and high-power microwave (HPM) weapons.

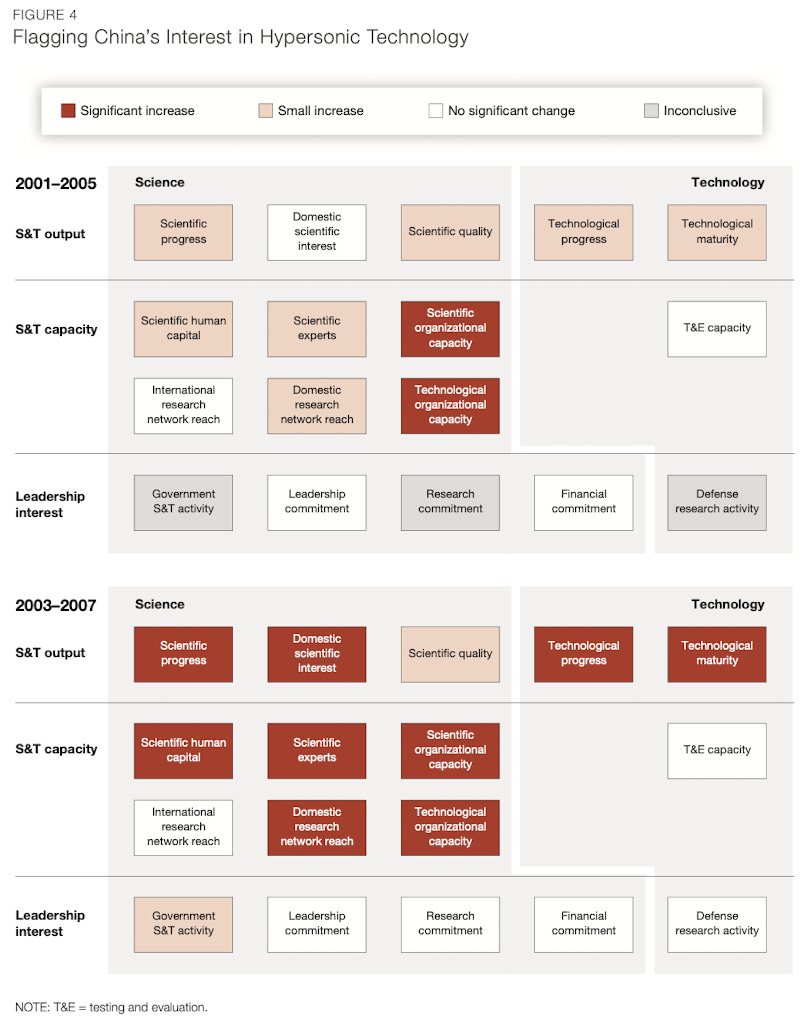

In the hypersonics case, using only open-source data, researchers assessed that China's interest and effort in this area would have been evident no later than 2007, as indicated by the red flags for S&T capacity in 2005 and output in 2007. This early warning could have prompted further intelligence collection and informed US R&D priorities and defense planning.

In the HPM weapons case, the framework revealed that China had been very active in related S&T domains, with Chinese researchers and organizations responsible for 90% of the world's new HPM-related patents. The analysis showed that China's HPM research had a heavily military flavor, embracing both offensive and defensive aspects. By 2030, China might be able to deploy weaponized technologies analogous to those developed in the US Counter-Electronics High Power Microwave Advanced Missile Project (CHAMP). The framework also identified specific research organizations and individuals deeply involved in China's HPM research, providing valuable information for further intelligence collection.

I urge you to read the full report to better understand the importance of the MAST framework and how it operates.