Special Forces, Manufacturing Might, Global Stakes

USSOF's Strategy for Tomorrow and the US-China Defense Industrial Base Race

Welcome back, security scholars.

This week, I have two insightful reports to share with you all. Their topics include:

How can US Special Operations Forces (USSOF) play a critical role in an era of great power competition?

How does the US defense industrial base compare to China’s?

Quick Tanks is a weekly collection and summary of the latest long-form analytic content on the topics of US defense, force structure, innovation, and policy considerations. We strive to aggregate all of the key sources of analysis and present brief, neutral summaries to help keep you informed. Should you feel inclined to learn more about any study, please reference the full report via the links provided.

The sponsor of the newsletter is the Hudson Institute’s Center for Defense Concepts + Technology.

Tank you for sharing and subscribing, and happy reading.

Stealth, speed, and adaptability

The role of special operations forces in strategic competition

By Clementine G. Starling and Alyxandra Marine

Atlantic Council

Link to Report Page

Focus: The report examines the evolving role of USSOF in the context of strategic competition, particularly against near-peer adversaries like China and Russia.Analysis: Pulling from consultations with and peer review from experts across the national security community, the report analyzes USSOF's distinct abilities in areas such as cyber, space, and undersea warfare, as well as its global engagement with allies and partners.Argument: USSOF, with its specialized skills and global footprint, is critically positioned to address the multi-domain threats posed by strategic competitors. By shifting the mindset towards strategic competition and prioritizing the development of non-kinetic and irregular warfare capabilities, USSOF can significantly contribute to deterring adversaries and shaping favorable outcomes for the US This requires not only a reevaluation of USSOF’s traditional roles but also a recognition of its potential to operate effectively across the entire spectrum of competition, from peacetime engagements to conflict scenarios.Insights: Expanding USSOF’s role in non-kinetic operations, including information warfare and civil affairs, can disrupt adversaries’ strategies without escalating to open conflict. Moreover, USSOF's ability to build and maintain deep relationships with allies and partners provides the US with strategic advantages in key regions, enabling operations that counter adversaries' influence and activities.Recommendations: See below for the full list of recommendations.This Atlantic Council report illuminates the crucial role of USSOF amidst the evolving national security landscape, where strategic competition with major powers like China and Russia intensifies across various global domains. Despite their critical capabilities in navigating these complex strategic competitions, USSOF's potential remains underutilized and misunderstood, often pigeonholed within the narrow confines of their counterterrorism achievements during the Global War on Terror. The report advocates a paradigm shift, urging a broader recognition of USSOF's capabilities across the full spectrum of strategic competition, highlighting their indispensable role in promoting US global interests and addressing vulnerabilities across the competition continuum.

“Globally positioned and readily deployed, USSOF provides decision-makers with low-visibility, small-footprint, and often low-cost options to secure US interests. It does this either by directly addressing threats or by indirectly engaging by, with, and through international allies and partners, thus allowing the United States to leverage partners’ capabilities and geographical familiarity and providing unique placement and access to partners that might be otherwise unavailable across the interagency. Accounting for just 3 percent of the US DOD’s budget, USSOF expands the response options available to the United States and its allies and partners, buying decision space for US and allied leaders. This is especially important in enabling US forces to shape the environment and conditions of competition well before conflict arises.”

Range of USSOF Missions

The report notes how USSOF’s versatility spans across a broad spectrum of operations critical to strategic competition, embodying twelve core activities:

“Direct Action: Executing short-duration strikes and small-scale offensive actions to seize, destroy, capture, exploit, recover, or damage designated targets.

Special Reconnaissance: Actions conducted in sensitive environments to collect or verify information of strategic or operational significance.

Unconventional Warfare: Executing actions to enable a resistance movement or insurgency that is aiming to coerce, disrupt, or overthrow a government or occupying power.

Foreign Internal Defense (FID): Activities geared toward supporting the host nation’s internal defense and development, including safeguarding against subversion, terrorism, insurgency, or other threats to stability and internal security.

Civil Affairs Operations (CAO): Enhancing the relationship between US and allied and partner military forces and civilian authorities in areas where military forces are present.

Counterterrorism (CT): Actions taken directly against terrorist networks, as well as actions to influence or render global and regional environments inhospitable to terrorist networks.

Military Information Support Operations (MISO): Planned activities aimed at conveying specific, pre-selected information to foreign audiences. Such information is often aimed at influencing the emotions, motives, objective reasoning, or behavior of foreign audiences, groups, individuals, or sometimes governments in a manner favorable to US or host-nation objectives.

Counter-proliferation of WMD: Activities to support US government efforts to curtain the development, possession, proliferation, and use of chemical, biological, radiological, and nuclear (CBRN) weapons by governments and non-state actors.

Security Force Assistance: Organizing, training, equipping, rebuilding, or advising various components of foreign security forces.

Counterinsurgency (COIN): The amalgamation of civilian and military efforts designed to end insurgent violence and facilitate a return to peaceful political processes.

Hostage Rescue and Recovery: Offensive measures taken to prevent, deter, preempt, and respond to hostage incidents, which may include the recapture of US facilities, installations, sensitive materials, or personnel in areas hostile to the United States.

Foreign Humanitarian Assistance: A range of Department of Defense humanitarian activities conducted outside the United States and its territories, and alongside other humanitarian entities, to relieve and reduce human suffering.”

These activities underscore USSOF's ability to address a multitude of challenges across the strategic competition landscape, demonstrating their critical importance beyond traditional counterterrorism roles.

Role of USSOF in Strategic Competition

The authors argue USSOF's contributions to US strategic competition are multifaceted, providing unique advantages in:

Global and persistent engagement with allies and partners: USSOF's extensive global network and enduring partnerships enable the US to counter adversaries' influence and support allies and partners effectively, strengthening collective security.

”USSOF’s security cooperation programs are dedicated to enhancing partner capability and capacity while increasing US regional access and influence. Key aspects of this relationship include fostering partner resilience against subversion and coercion—and, when necessary, resistance to occupation. A prime example of this is the significant role that USSOF played in helping Ukraine build and train a professional and capable military force after the illegal Russian annexation of Crimea in 2014. At that time, Ukrainian military forces lacked command and control and were not well-trained in operating key capabilities. Following 2014, US, United Kingdom (UK), and other allied SOF trained the Ukrainian military, supporting its evolution into the professional and capable military force we see today, which has been much better positioned to respond to and tenaciously fight Russia’s ongoing war against Ukraine.”

Gaining placement and access across the globe: The strategic positioning of USSOF across the globe offers the US a significant advantage in projecting power and conducting operations in response to emerging threats. Their ability to operate discretely in politically sensitive or denied areas provides the US with eyes and ears on the ground, offering critical insights into adversary actions and intentions. This global presence, characterized by agility and a low-profile approach, enables USSOF to conduct operations that deter adversaries and reassure allies without escalating tensions unnecessarily, maintaining a balance crucial for strategic stability.

Achieving Effects Across the Competition Continuum: USSOF's expertise in operating in the gray zone — the ambiguous space below the threshold of open conflict — allows the US to counter adversaries' actions effectively without triggering wider conflicts. Their proficiency in information operations, unconventional warfare, and influence campaigns disrupt adversaries' plans and spreads discord within their ranks. This capacity to operate effectively across the competition continuum ensures the US can respond flexibly to threats, utilizing a full range of non-kinetic and kinetic tools to achieve strategic objectives and shape the operational environment in favor of US interests.

Cutting-Edge Use of Technology: The forward-leaning posture of USSOF in adopting and integrating emerging technologies into their operations sets them apart as a force multiplier within the US military arsenal. Their willingness to experiment with and operationalize new technologies, from artificial intelligence and cyber capabilities to advanced reconnaissance and surveillance tools, ensures that USSOF maintains a technological edge over adversaries. This technological adeptness enhances their operational effectiveness, enabling them to conduct missions with greater precision, stealth, and impact, thereby solidifying their role as a key component of the US's strategic competition efforts.

Recommendations

Adapt Mindset for Strategic Competition: USSOF should expand their role in strategic competition by embracing non-kinetic activities and irregular-warfare concepts to counteract the sophisticated capabilities of near-peer adversaries like China and Russia.

Synchronize Efforts Across Agencies and Allies: To address the complexities of strategic competition effectively, USSOF must enhance collaboration with interagency partners, allied and partner militaries, and the Joint Force, leveraging their capabilities in pre-conflict roles.

Enhance Capabilities in Emerging Domains: USSOF must bolster their expertise in cyber, space, undersea warfare, and other areas like the Arctic, and invest in technologies such as artificial intelligence to ensure dominance in complex environments.

Define and Measure Success: USSOF needs to establish clear strategic competition objectives and develop mechanisms to track progress, allowing for a better understanding of their contributions and impact.

Improve Integration with US Military Services: Enhanced understanding, communication, and global campaign planning between USSOF and the broader US military are crucial for leveraging strategic advantages effectively across various domains and partners.

Identify and Leverage Innovations: USSOF should continue to lead in scouting, testing, and adopting cutting-edge technologies from nontraditional defense-industrial partners, enhancing their operational capabilities and maintaining a technological edge.

Maintain and Enhance International Cooperation: USSOF must ensure continuous and effective collaboration with allied special operations forces, sharing plans, focus areas, and best practices to build a unified approach against common strategic threats.

I highly recommend reading the full report to better understand the role of USSOF in US strategic competition.

China Outpacing U.S. Defense Industrial Base

The U.S. and Chinese Defense Industrial Bases in an Era of Great Power Competition

By Seth G. Jones and Alexander Palmer

Center for Strategic and International Studies

Link to PDF; Link to Report Page

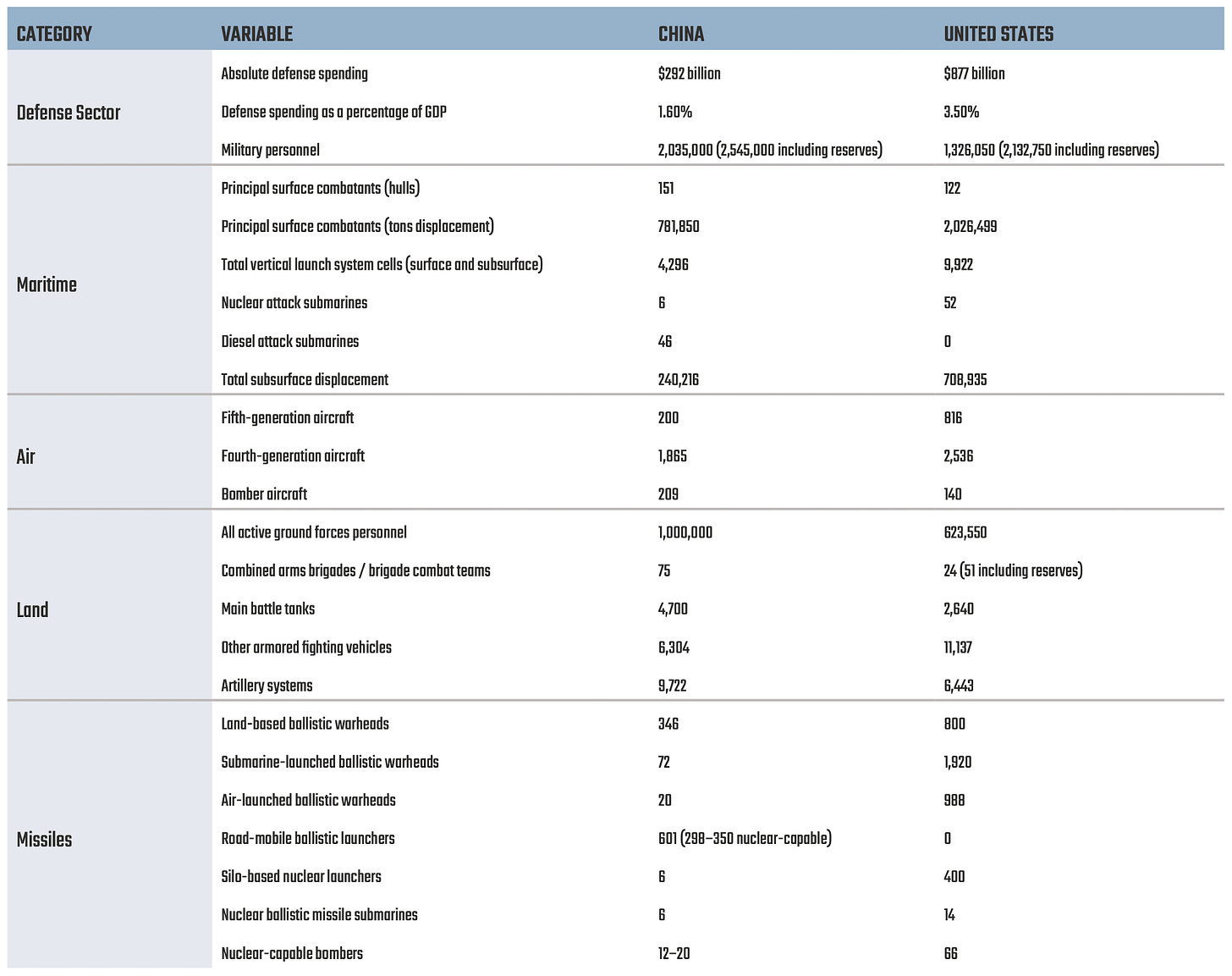

Focus: The report examines the defense industrial capacities of the US and China within the context of their strategic competition.Analysis: The authors leverage a wide array of data sources including government reports, defense spending figures, production rates of military assets, and expert interviews to comprehensively compare the US and Chinese industrial bases.Argument: The US defense industrial base, while formidable, is currently ill-equipped to meet the surging demands of global military commitments and the strategic challenge posed by China's rapidly advancing defense sector. This inadequacy is attributed to issues like underinvestment, bureaucratic inertia, supply chain vulnerabilities, and a lack of a cohesive strategy to foster innovation and production efficiency within the defense industry.Insights: China has become the world's largest shipbuilder, significantly outpacing the US in both capacity and output, posing strategic challenges in naval dominance. But despite advancements, China's defense industry still relies on critical foreign technologies, especially in aerospace engines and semiconductor manufacturing. Meanwhile, the US has not fully leveraged its alliances to strengthen its defense industrial base, in contrast to China's more isolated position.Recommendations: See below for the full list of recommendations.This CSIS report underscores the critical juncture at which the US finds itself in the realm of national security. With China's defense industrial base rapidly advancing in capability and output, the US confronts the stark reality of its own industrial base's stagnation. The report's central thesis posits that the US risks ceding strategic ground to China unless significant and urgent reforms are undertaken to revitalize its defense industrial base, thereby ensuring readiness and deterrence in an increasingly contested global landscape.

China’s Industrial Base

The authors detail China's strategic investments in its defense industrial base, highlighting a concerted effort to eclipse US capabilities in key sectors such as shipbuilding and missile technology.

“The main beneficiary of China’s defense industrial growth has been the People’s Liberation Army Navy (PLAN), especially through a growth in China’s shipbuilding capabilities. China’s ability to rapidly build large numbers of ships represents a possible advantage in a protracted war in the Indo-Pacific. China is now the world’s largest shipbuilder by a significant margin. It has a shipbuilding capacity that is more than 230 times larger than that of the United States and sufficient to build 23 million tons of vessels compared to less than 100,000 tons in the United States. According to U.S. Navy estimates, a single Chinese shipyard currently has more capacity than all U.S. shipyards combined. The PLAN’s growth has made it the largest navy in the world. But the U.S. Navy likely remains more capable by most measures, including physical indicators like tonnage or Vertical Launch System (VLS) cells and operational competencies such as anti-submarine warfare, joint operations, and long-range targeting.”

China's defense budget has seen consistent year-on-year increases, with a notable 7.2 percent hike in 2024 alone. Compared to the defense spending of other Indo-Pacific nations, China’s rising investment is particularly pronounced.

As for missile technology, China has positioned itself as a leading global power in the production and deployment of a wide range of missile systems, from short-range ballistic missiles (SRBMs) to advanced intercontinental ballistic missiles (ICBMs) equipped with hypersonic glide vehicles. Moreover, the induction of the J-20 stealth fighter into the PLA Air Force, alongside investments in unmanned aerial systems and space warfare technologies, underscores China's ambition to achieve superiority in the air and beyond.

Despite its formidable advancements, the CSIS report also identifies critical vulnerabilities within China's defense apparatus. Notably, China's heavy reliance on foreign technology and the persistent challenge of integrating cutting-edge innovations into its military capabilities present significant obstacles. Moreover, issues such as lack of combat experience and potential operational inefficiencies further compound the challenges faced by China, offering the United States strategic opportunities to leverage in maintaining a competitive edge.

US Defense Industrial Base

Conversely, the US defense industrial base confronts a multitude of challenges that hinder its ability to keep pace with China's military-industrial expansion. The US defense industrial ecosystem is mired in a quagmire of regulatory complexities and bureaucratic inertia that stifles innovation and delays the fielding of new technologies. The procurement process is encumbered by protracted timelines and a risk-averse culture that prioritizes procedural adherence over operational urgency. This environment has deterred new entrants and stifled the growth of small and medium-sized enterprises, which are often the source of transformative innovations.

Furthermore, while the US enjoys a broad network of allies and partners, the current frameworks for defense collaboration and technology sharing are inadequate to leverage this strategic advantage fully. The mechanisms for international defense cooperation, such as the Foreign Military Sales (FMS) and technology transfer programs, are often criticized for their sluggish pace and the bureaucratic hurdles that impede the timely transfer of critical defense capabilities to allies. This situation limits the collective defense posture and interoperability essential for deterring aggressive actions by adversaries.

“The entire [Foreign Military Sales] process—from initial discussions to [Letter of Request], [Letter of Acceptance], production, and modifications—is too long. It takes an average of 18 months to get FMS cases on contract. There is also no real accountability in the FMS system. The Department of State statutorily owns it, but execution largely falls to the Department of Defense and is split among the military services and several Department of Defense agencies. No one is held accountable for strategic success or failure. Partner and ally requests for U.S. systems can go unanswered for months or even years. FMS programs are executed under a U.S. government contract negotiated and awarded by a U.S. military service contracting officer on behalf of the FMS partner. The Department of Defense contracting community is understaffed. FMS contracts are sometimes given a low priority by contracting officers, who look first to support U.S. service personnel, then to contracts to support innovation for next-generation capabilities for U.S. service personnel, then to FMS. In addition, staffing constraints, technological limitations, and the increasing complexity of systems could slow the rate at which transactions are approved if there is a major increase in FMS.

Even for close allies, there are notable delays, confusion, and unpredictability with the U.S. technology transfer process—a sign of a peacetime, not a wartime, process. The U.S. Technology Security and Foreign Disclosure (TSFD) process often causes delays for close allies, which prevent them from doing technical assessments before they even get to the LOR stage. The TSFD process is also far too opaque and unpredictable. These challenges can significantly impact time-sensitive actions, such as refitting ships during fixed docking periods. With the United Kingdom, for example, U.S. delays held up a routine upgrade on sonar systems for UK Royal Navy submarines for several months, while another UK submarine had to wait months to be serviced by a cleared contractor until the U.S. Department of State authorized an export-controlled component. As one analysis concluded, ‘months went by waiting for a license that just added cost and risk to an ally’s military capability.’ More broadly, the United Kingdom spends a shocking $500 million each year—almost 1 percent of its defense budget—complying with ITAR regulations. As another assessment concluded: ‘When close U.S. allies—or their defense firms—wish to develop technology or acquire capability from the United States, they have to navigate a byzantine system of regulation. This costs time and money, undermines allies’ sovereignty, stifles innovation, and blunts the United States’ edge in the strategic competition with China.”

To remedy the current inefficiencies in the US defense industrial base, the authors prescribe the following series of recommendations:

White House-led Effort:

Establish a Presidential Defense Industrial Task Force: Create a high-level task force, led by the White House, to provide strategic oversight, coordinate interagency efforts, and streamline decision-making processes related to defense industrial policies and initiatives.

Implement Strategic Guidance and Oversight Mechanism: This body should be vested with the authority to implement strategic guidance, resolve interagency conflicts, and oversee the execution of national defense industrial strategies, ensuring alignment with national security objectives.

Defense Production:

Increase Budgetary Allocations: Advocate for and secure increased budgetary allocations for defense spending, targeting a percentage of GDP that reflects the strategic imperatives of countering near-peer adversaries and sustaining global military leadership.

Expand Multiyear Procurement Contracts: Incentivize and facilitate the adoption of multiyear procurement contracts to stabilize demand, encourage industrial investment in capacity expansion, and enhance the predictability of defense procurement.

Augment and Diversify Strategic Stockpiles: Invest in the expansion and diversification of strategic stockpiles, including munitions, critical minerals, and components essential for the rapid scaling of production in times of crisis.

Cultivate STEM Talent and Skilled Trades: Launch comprehensive initiatives to attract, train, and retain a skilled workforce capable of supporting advanced defense manufacturing and innovation.

Enhance Supply Chain Resilience: Implement policies to strengthen and secure supply chains for critical materials and components, fostering domestic production capabilities and reducing dependence on adversarial sources.

Allies and Partners:

Deepen Defense Industrial Cooperation: Establish frameworks for deeper defense industrial cooperation with allies and partners, focusing on joint research and development, co-production agreements, and interoperability standards to bolster collective defense capabilities.

Streamline Technology Transfer and Export Controls: Reform and streamline technology transfer and export control processes to facilitate the rapid and secure sharing of defense technologies and capabilities with trusted allies and partners, enhancing the global defense posture against common threats.

To engage with the analysis and recommendations further, I recommend reading the full report.

Editorial Note: While this report highlights the glaring issues with the US defense industrial base, especially compared to its Chinese counterpart, the report’s recommendations remain rather conventional. Increasing spending, working with allies, enhancing public-private cooperation, etc. are well-known directions but they are broad and are easier said than done. As such, there persists a need for novel and actionable guidance that can more practically translate to political, operational, or institutional initiatives.